Despite receiving significant attention in the financial and investment world, many people do not know how to buy the cryptocurrency Bitcoin, but doing so is as simple as signing up for a mobile app. With cryptocurrency back in the news again, now’s a better time than ever to delve into the weeds and learn more about how to invest. Here’s a breakdown of everything you need to know in order to start buying bitcoin.

KEY TAKEAWAYS

- To buy bitcoin, the first step is to download a bitcoin wallet, which is where your bitcoins will be stored for future spending or trading.

- Traditional payment methods such as a credit card, bank transfer (ACH), or debit cards will allow you to buy bitcoins on exchanges that you can then send to your wallet.

- Most U.S.-sanctioned bitcoin platforms will require you to provide photo I.D. and other information to make sure you don’t break money laundering laws, or try to cheat on taxes.

- Bitcoin is still a new asset class that continues to experience a great deal of price volatility, and its legal and tax status also remains questionable in the U.S. and abroad.

Steps to Buy Bitcoin

1. Digital Wallet

In order to conduct transactions on the bitcoin network, participants need to run a program called a “wallet.”

The public key is the location where transactions are deposited to and withdrawn from. This is also the key that appears on the blockchain ledger as a user’s digital signature, not unlike a username on a social media newsfeed. The private key is the password required to buy, sell, and trade the bitcoin in a wallet. A private key should be a guarded secret and only used to authorize bitcoin transmissions. Some users protect their private keys by encrypting a wallet with a strong password and, in some cases, by choosing the cold storage option; that is, storing the wallet offline.

Bitcoin is not technically “coins,” so it only seems right that a bitcoin wallet would not actually be a wallet. Bitcoin balances are maintained using public and private “keys,” which are long strings of numbers and letters linked through the mathematical encryption algorithm used to create them.

2. Personal Documents

The U.S. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti-Money Laundering Policy.

In order to buy and sell bitcoin, you will need to verify your identity using several personal documents including your driver’s license and Social Security number (SSN).

3. Secure Internet Connection

If you choose to trade bitcoin online, use discretion about when and where you access your digital wallet. Trading bitcoin on an insecure or public wifi network is not recommended and may make you more susceptible to attacks from hackers.

4. Bank Account, Debit Card, or Credit Card

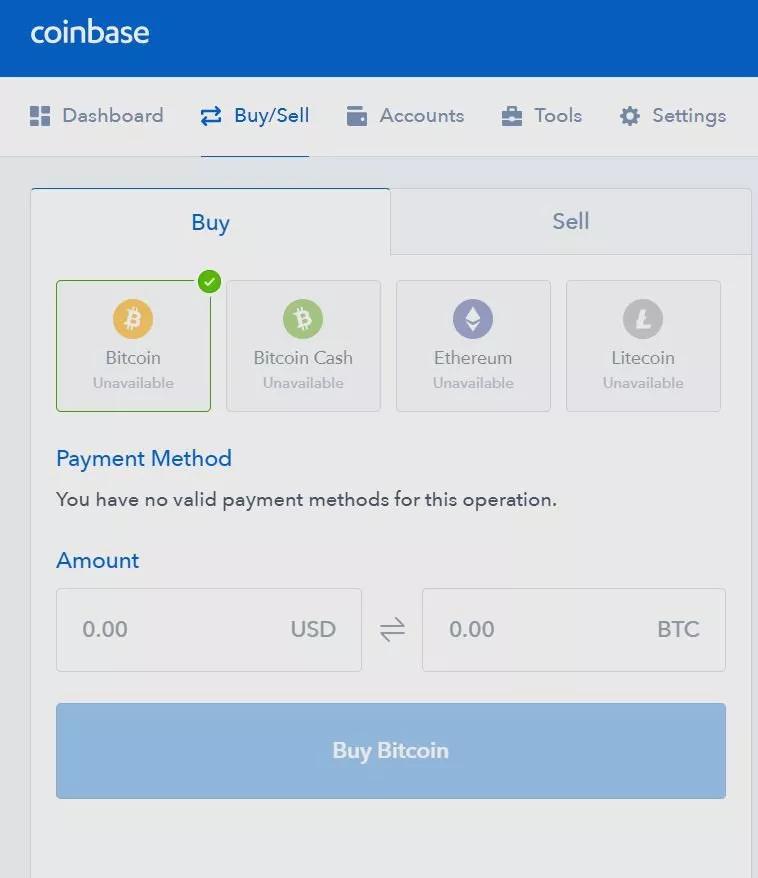

Once you have a bitcoin wallet, you can use a traditional payment method such as a credit card, bank transfer (ACH), or debit card to buy bitcoins on a bitcoin exchange. The bitcoins are then transferred to your wallet. The availability of the above payment methods is subject to the area of jurisdiction and exchange chosen. Below is a screenshot of the bitcoin interface on Coinbase showing how to buy and sell bitcoin and also Bitcoin Cash, Ethereum, and Litecoin, which are other popular virtual currencies. The user clicks the “Buy” tab to buy digital currency and the “Sell” tab to sell digital currency. You select which currency you are buying/selling and which payment method (your bank account or credit card) you want to use.

Depending upon the exchange, there may be benefits and disadvantages to paying with cash, credit or debit card, or bank account transfer. For instance, while credit and debit cards are among the most user-friendly methods of payment, they tend to require identification and may also impose higher fees than other methods. Bank transfers, on the other hand, typically have low fees, but they may take longer than other payment methods

5. Bitcoin Exchange

After you’ve set up your wallet with a payment method, you’ll need a place to actually buy bitcoin. Users can buy bitcoin and other cryptocurrencies from online marketplaces called “exchanges,” similar to the platforms that traders use to buy stock. Exchanges connect you directly to the bitcoin marketplace, where you can exchange traditional currencies for bitcoin.

Remember that the bitcoin exchange and the bitcoin wallet are not the same things. Bitcoin exchanges are similar to foreign exchange markets. The exchanges are digital platforms where Bitcoin is exchanged for fiat currency—for example, bitcoin (BTC) for U.S. dollars (USD). While exchanges offer wallet capabilities to users, it is not their primary business. Since wallets must be secure, exchanges do not encourage storing large amounts of bitcoin or for long periods. Therefore, it is advisable to transfer your bitcoins to a secure wallet. Because security must be your top priority when choosing a bitcoin wallet, opt for one with a multi-signature facility.

Alternate Ways of Buying Bitcoin

While an exchange like Coinbase remains one of the most popular ways of purchasing bitcoin, it is not the only method. Below are some additional processes bitcoin owners utilize.

- Bitcoin ATMs: Bitcoin ATMs act a bit like in-person bitcoin exchanges. Individuals can insert cash into the machine and use it to purchase bitcoin which is then transferred to a secure digital wallet. Bitcoin ATMs have become increasingly popular in recent years; Coin ATM Radar can help to track down the closest machines.

- P2P Exchanges: Unlike decentralized exchanges, which match up buyers and sellers anonymously and facilitate all aspects of the transaction, there are some peer-to-peer (P2P) exchange services which provide a more direct connection between users. Local Bitcoins is an example of such an exchange. After creating an account, users can post requests to buy or sell bitcoin, including information about payment methods and price. Users then browse through listings of buy and sell offers, choosing those trade partners with whom they wish to transact. Local Bitcoins facilitates some of the aspects of the trade. While P2P exchanges do not offer the same anonymity as decentralized exchanges, they allow users the opportunity to shop around for the best deal. Many of these exchanges also provide ratings systems so that users have a way to evaluate potential trade partners before transacting.

This Post Has One Comment

Pingback: itemprop="name">The Latest Loophole That I Am Using To Make Good Money – Lucrativehood