What Is a Bitcoin Halving?

Bitcoin is halving set to occur on May 11, 2020, at around 4 pm est. To explain what a Bitcoin Halving is we must first explain a bit about how the Bitcoin network operates.

Bitcoin and its blockchain are basically a collection of computers, or nodes, around the world that all have Bitcoin’s code downloaded on them. Each of these computers have all of Bitcoin’s blockchain stored on them. This means that each computer has the entire history of Bitcoin transactions, which ensures that no one can cheat the system as every computer would deny the transaction. In this way, Bitcoin is entirely transparent and no one can make a transaction without everyone seeing it happen. Even those who do not participate in the network as a node or miner can view the transactions taking place live by looking at block explorers.

KEY TAKEAWAYS

- Bitcoin is halving on May 11, 2020, at around 4 pm est.

- A Bitcoin halving event is when the reward for mining Bitcoin transactions is cut in half.

- This event also cuts in half Bitcoin’s inflation rate and the rate at which new Bitcoins enter circulation.

- Both previous halvings have correlated with intense boom and bust cycles that have ended with higher prices than prior to the event.

More computers, or nodes, added to the blockchain increase its stability and power. There are currently over 10,000 nodes running Bitcoin’s code. While anyone can participate in Bitcoin’s network as a node, as long as they have enough storage to download the entire blockchain and its history of transactions, not all of them are miners.

Mining

Bitcoin mining is the process where people use their computers to participate in Bitcoin’s blockchain network as a transaction processor. Bitcoin uses a system called Proof of Work. This means that miners must prove they have put forth effort in processing transactions to be rewarded. This effort includes the time and energy it takes to run the computer hardware and solve complex equations.

Faster computers with certain types of hardware yield larger rewards and some companies have designed computer chips specifically built for mining. These computers are tasked with processing Bitcoin transactions and they are rewarded for doing so.

The term mining is not used in a literal sense but used in a reference to the way precious metals are gathered. Bitcoin miners solve mathematical problems and confirm the legitimacy of a transaction. They then add the transactions to the end of a block and create chains of these blocks of transactions, forming the blockchain. When a block is filled up with transactions, the miners that processed and confirmed the transactions within the block are rewarded with Bitcoin. Transactions of greater monetary value require more confirmations to ensure security. This process is called mining because the work done to get new Bitcoin out of the code is the digital equivalent to the physical work done to pull gold out of the earth. More information on the technic

Halving

Every 210,000 blocks mined, or about every four years, the reward given to Bitcoin miners for processing transactions is cut in half. This cuts in half the rate at which new Bitcoin is released into circulation. This is Bitcoin’s way of using a synthetic form of inflation that halves every four years until all Bitcoin is released and is In circulation.

This system will continue until around 2140. At that point, miners will be rewarded with fees for processing transactions that network users will pay. These fees ensure that miners still have the incentive to mine and keep the network going. The idea is that competition for these fees will cause them to remain low after halvings are finished.

The halving is significant because it marks another step in Bitcoin’s dwindling finite supply. There are only 21,000,000 Bitcoins in existence. At the time of writing, there are 18,361,438 Bitcoins already in circulation, leaving just 2,638,562 left to be released via mining rewards.

In 2009, the reward for each block in the chain mined was 50 Bitcoins. After the first halving it was 25, then 12.5, and come May 11th, 2020 It will be 6.25 Bitcoins per block. To put this in another context, imagine if the amount of gold mined out of the earth was cut In half every four years. If gold’s value is based on its scarcity, then a “halving” of gold output every four years would theoretically drive its price higher.

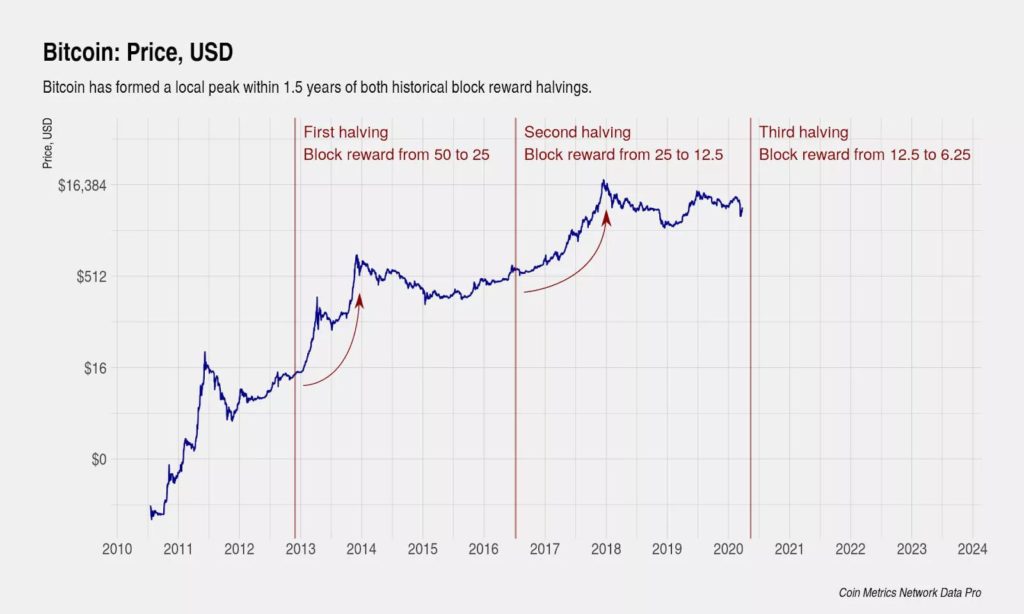

Coinmetrics logarithmic chart of Bitcoin price action following halvings.

These halvings reduce the rate at which new coins are created and thus lower the available supply. This can cause some implications for investors as other assets with low supply, like gold, can have high demand and push prices higher.

In the past, these Bitcoin halvings have correlated with massive surges in Bitcoin’s price. The first halving, which occurred in November of 2012, saw an increase from about $11 to nearly $1,150. The second Bitcoin halving occurred in July of 2016. The price at that halving was about $650 and by December 16th, 2017, Bitcoin’s price had soared to nearly $20,000. The price then fell over the course of a year from this peak down to around $3,200, a price nearly 400% higher than Its pre-halving price.

The theory of the halving and the chain reaction that it sets off works something like this:

Reward is halved → half the inflation → lower available supply → higher demand → higher price → miners incentive still remains, regardless of smaller rewards, as the value of Bitcoin is increased In the process.

In the event that a halving does not increase demand and price, then miners would have no incentive as the reward for completing transactions would be smaller and the value of Bitcoin would not be high enough. To prevent this, Bitcoin has a process to change the difficulty it takes to get mining rewards. In the event that the reward has been halved and the value of Bitcoin has not increased, the difficulty of mining would be reduced to keep miners incentivized. This means that the quantity of Bitcoin released as a reward is still smaller but the difficulty of processing a transaction is reduced.

This process has proven successful twice. So far, the result of these halvings has been a ballooning in price followed by a large drop. The crashes that have followed these gains, however, have still maintained prices higher than before the halvings. For example, as mentioned above, the 2018 bubble saw Bitcoin rise to around $20,000, only to fall to around $3,200. This is a massive drop but Bitcoin’s price before the halving was around $650. While this system has worked so far, the halving is typically surrounded by immense speculation, hype, and volatility, and it is unpredictable as to how the market will react to these events in the future.